Pharmacy benefit managers (PBMs) were created with good intentions – to manage prescription drug costs, help insurers contain drug spending and ultimately ensure patients have access to the medications they need. Their existence is meant to keep prescription drug economics from being a zero sum game for industry and patients alike. However, ongoing actions by many PBMs indicate they’ve become more interested in making a profit than helping patients. Time and again, PBMs divert potential prescription drug savings for patients – and dollars that pharmacies need to operate – into their own pockets. This needs to stop.

Can PBMs get back on track, working in pharmacies’ and patients’ best interests?

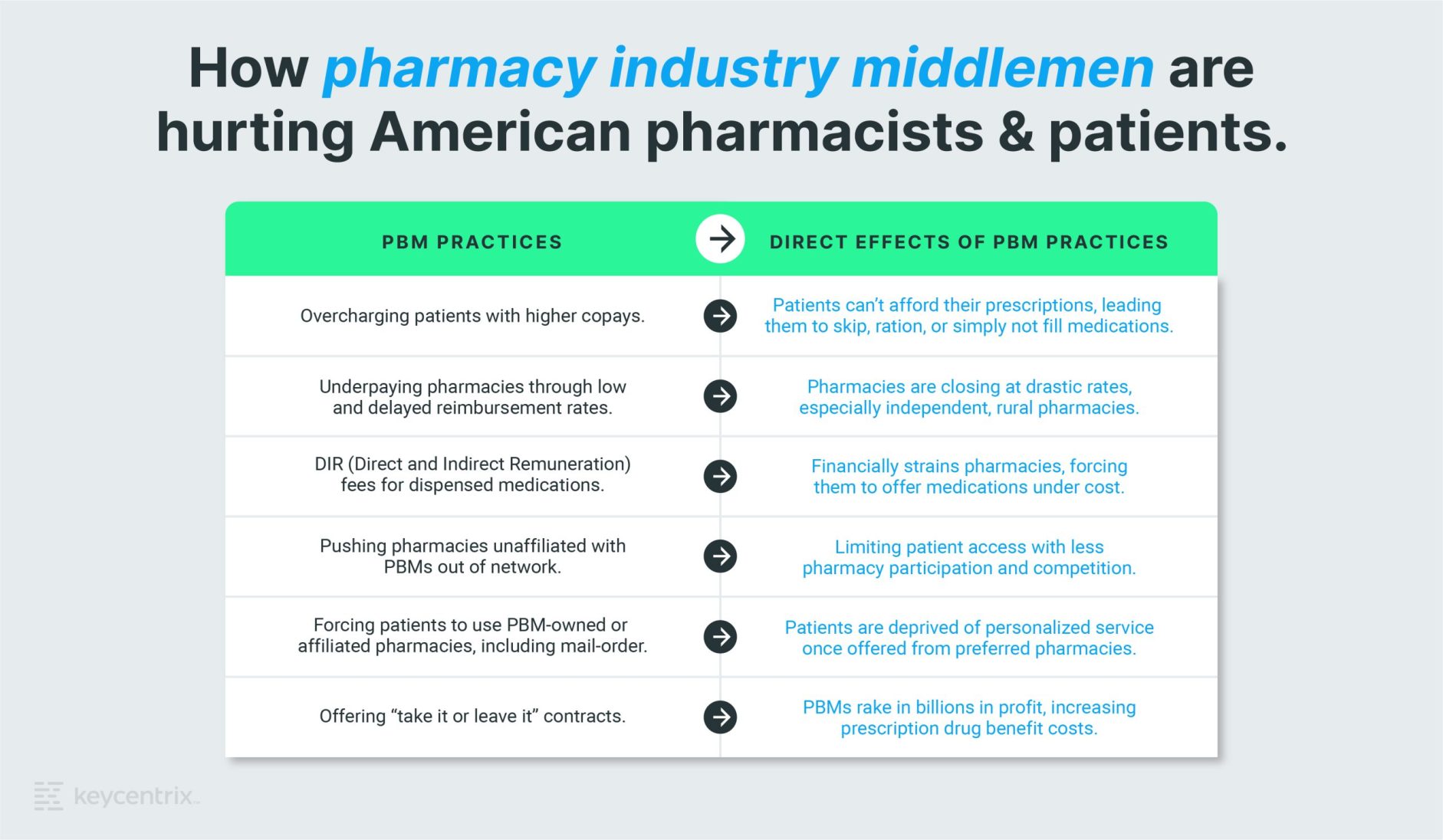

How PBM Practices Hurt Pharmacies

The Pharmaceutical Care Management Association (PCMA), the national association representing America’s PBMs, indicates that PBMs serve as advocates in the healthcare system, working to lower prescription drug costs for patients and payers, saving them, on average, $1,040 per person per year. PCMA says research also shows PBMs save payers and patients 40 to 50 percent on prescriptions and related medical costs compared to what they’d spend without them. While these results may very well be accurate within the context they present, there are numerous ways PBMs do business that leave a path of destruction along the way, devastating pharmacies and the patients they serve.

One way is by setting reimbursement rates too low to begin with. When PBMs reimburse pharmacies for dispensing medications, these rates are often far below the actual cost of the medications, leaving pharmacies on the hook to pay the difference and later appeal their losses. Unfortunately, pharmacies say PBMs regularly decline these appeals. It can also take PBMs a month or more to reimburse pharmacies for prescription claims.

PBMs have implemented DIR fees, or “direct and indirect remuneration fees,” for certain claims to increase their profits. Through this practice, PBMs claw back – sometimes more than six months later – part of the reimbursements they’ve already paid pharmacies for dispensing medications. Payers claim these DIR fees are due to a pharmacy’s performance on quality measures. However, pharmacies say these measures are not clearly and openly defined, unpredictable, inconsistent, and produce incredibly high surprise bills forcing them to offer medications under cost.

These harmful PBM practices have financially strained pharmacies, causing them to close their doors at a significant rate. Between 2009 and 2015, one in eight pharmacies (or 9,654 pharmacies) closed across the nation, according to a University of Illinois at Chicago study. Moreover, their analysis showed independent pharmacies were three times more likely to close than chain pharmacies. Independent, rural pharmacies with a higher reliance on drug sales as a main source of revenue were especially susceptible to closing. According to Rural Policy Research Institute’s Center for Rural Health Policy Analysis, approximately 630 rural communities with at least one retail (independent, chain or franchise) pharmacy in March 2003 had no retail pharmacy in 2018, and 302 rural communities lost all but one local pharmacy during that same time. Low and late reimbursements were said to have contributed to the store closures, causing patients to be without reliable prescription access.

Another practice that hurts pharmacies is when PBMs own or are affiliated with competing retail, mail-order, and specialty pharmacies, and require or incentivize patients to use these pharmacies instead. PBMs have also been known to unexpectedly push pharmacies unaffiliated with PBMs from being in-network to out-of-network.

Something’s got to give.

So why do PBMs continue to exist if they’re causing so much harm? The answer is simple: money.

PBMs rake in billions of dollars in profits each year by overcharging patients, underpaying pharmacies, and delaying payments. In fact, three major PBMs (CVS Caremark, Express Scripts, and OptumRx) make up 80% of the market and are ranked more profitable than the drug manufacturers whose prices they promised to control. They make exponentially more money than the people who engineered and produce the medicine.

These PBMs also either own, or are owned by, large national health plans. Furthermore, their control over the pharmacy industry is only mounting as PBMs consolidate. NCPA indicates that PBMs cover 77 percent of insured individuals, which means pharmacies can’t refuse to contract with them when 30 to 50 percent of patients would be covered under that contract. Pharmacies ultimately have no bargaining power in negotiating these “take it or leave it” contracts.

How PBMs Negatively Impact Patients

While so far we’ve only talked about how PBMs negatively impact pharmacies, let’s get into how their practices also hurt patients.

Because of their position in the market, PBMs can retain rebates or discounts rather than passing savings onto customers. This can create a conflict of interest that hurts both pharmacies and their patients, leading to higher drug prices for patients and lower reimbursements for pharmacies. To make matters worse, PBMs don’t repay patients for overpaid copays after they have clawed back pharmacy reimbursements. This means patients end up paying more for prescription drug costs that are counted against their coverage limit, which is known to lead to Medicare coverage gap issues and taxpayers ultimately on the hook to cover their healthcare expenses.

I wish I was exaggerating, but these practices are significant enough that a few states have enacted laws to protect taxpaying residents and pharmacies. Some state governments have forced PBMs to use competitive marketplaces where they must be transparent about practices and prescription drug pricing to win that state’s business.

PBMs argue they lower prescription drug benefit costs for plan sponsors. They also point out that patients’ out-of-pocket expenses, as a percentage of the total prescription drug spend, have been falling for decades. However, pharmacy advocates say this is misleading. Because between 1987 and 2019, patient out-of-pocket costs have increased 222 percent (from $16.7 billion to $53.7 billion), and prescription drug benefit costs have increased 1279 percent (from 26.8 billion to $369.7 billion). During that same period, price inflation only grew 125.9 percent.

As a way to entice patients to receive the lowest possible copay, some PBMs also require them to use PBM-owned or affiliated pharmacies. This not only hurts independent pharmacies, but it can also leave patients with little to no control over important healthcare decisions. For example, patients may be deprived of the level of personalized service and attention independent specialty pharmacies provide so well.

When low and late reimbursements impact pharmacy closures, especially in rural areas, residents are forced to drive long distances for their prescriptions or use mail-order services that don’t offer clinical services. Rural pharmacy closures are also proven to impact patient’s adherence to prescription drugs, affecting their health and quality of life. In fact, nearly 3 in 10 American adults say they’ve skipped doses, cut pills in half, or simply not filled prescriptions due to cost. Patients are hurting their ability to be healthier, simply because they cannot afford their medications.

And what happens when PBMs change which pharmacies are in their network without informing patients ahead of time? As a result, patients may fill prescriptions at a pharmacy not in their network and be required to pay full price instead. Again, this flies in the face of what healthcare should be – helping patients get what they need at prices they can afford.

What Can Be Done?

To get the PBM industry back to what it was originally created for, we need stricter oversight and regulation to ensure they serve their highest purpose – managing prescription drug costs and benefits overall.

It’s time for PBMs to change their ways.

Pricing transparency, fair and timely reimbursement rates, eliminating DIR fees, and allowing patients to use pharmacies they prefer is the right place to start.

Although some regulation has begun and additional measures are on the horizon, it’s sadly not enough. And while we’re encouraged that the Federal Trade Commission is reviewing PBM practices, we know more can, and must, be done. Whether it’s oversight and regulation, or free market, correction is needed before PBMs decimate the pharmacy industry. We must come together and continue working to raise awareness about these issues and pressure lawmakers to enact meaningful change.

Only then will we see lower drug prices, keep pharmacies open, and ensure patients have access to the affordable medications they need and deserve.

Shareable graphic: How pharmacy industry middlemen are hurting American pharmacists & patients.

Want to share this information with others? Download this graphic to post on social media.

Download